The way to assure investors and shareholders of your company’s leadership value is to quantify it – accurately, write Dave Ulrich and Justin Alle

[button type=”large” color=”black” rounded=”1″ link=”http://issuu.com/revistabibliodiversidad/docs/pdf_book_q2_2016_mid_res/38″ ]READ THE FULL GRAPHIC VERSION[/button]

The board of directors of a publicly traded company was frustrated at its firm’s consistently underwhelming stock price. It invited a leading investment counsellor to undertake an assessment and offer advice. The adviser reported that their firm had the highest cash flow (gross margins) in the industry and the highest innovation rate (percent of revenue from new products in past four years), but its share price lagged behind the industry by about 15-20%. The board said it knew this, which was why they invited the counsellor to come in to provide advice. But, when pushed for solutions, the adviser had little to offer.

A large global conglomerate decided to invest in extensive leadership development. It built a remarkable training facility and organized an outstanding leadership development curriculum. It estimated that, over five years, it would invest approximately $500 million in leadership development. The chief executive was personally committed to this major investment, but asked the leadership development professionals to help him justify the investment for his board. The leadership development team struggled to identify substantive measures and benchmarks.

Volkswagen hit major trouble when it was reported that its emissions inspections had been tampered with. The carmaker’s stocks plummeted, wiping billions off the share price of a once-vaunted industry leader.

These three examples all have an underlying origin: the quality of leadership shapes shareholder value.

Volkswagen’s leaders cost their shareholders billions of dollars of market value because investors lost confidence in the quality of leadership. They need to figure out how to regain this lost confidence quickly, to recover the erosion of market value.

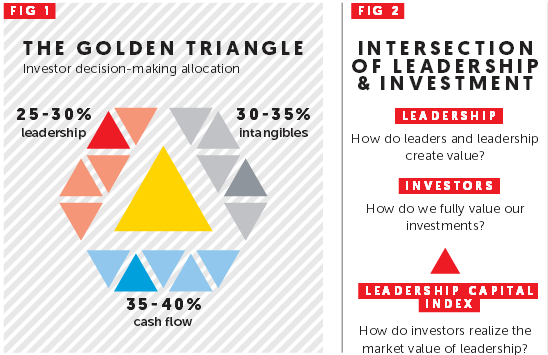

We found that investors allocate 35-40% of their decision making to cash flow, 30-35% to intangibles, and 25-30% to leadership (see figure 1). However, investors are beginning to realize that the quality of a firm’s leadership is also behind much of its intangibles value.

The intersection of leadership insights and investor value results in what we call the Leadership Capital Index (LCI). This index offers investors insights into the quality of leadership and gives leadership a clear outcome for their work (see figure 2).

Creating the index was a daunting task. We wanted it to offer precise insights about the impact of leadership on investor confidence, about the specific leadership competencies that drove that confidence, and we wanted to find this leadership magic number from existing reporting documents (balance sheet and income statement). Such leadership holy grails do not exist. There is not a standard of leadership that applies universally across all organizations.

Two domains of effective leadership

But we found that we could create an index that gives investors increasing insight and confidence in their assessment of leadership and guides leadership development efforts to help them build investor confidence. Our index draws on extensive leadership theory, research and practice, and suggests there are two domains of effective leadership that investors can assess: individual leaders and organizational leadership. Within each domain are five specific elements of leaders and leadership that investors may assess (see figure 3).

Our framework offers a thorough overview of the quality of leaders and leadership within an organization. Each of these ten elements of leadership can then be assessed through:

– On-site visits and interviews

– Corporate reports (for example, engagement scores or turnover of key employees)

– Social media sites

An index may then be created that audits the quality of leadership within an organization.

Who can use the index?

Once an LCI has been created for a firm, it should be used by multiple stakeholders to increase market value.

Investors

Active investors who research the companies in which they invest (for example, pension funds, private equity, venture capital, portfolio managers) can go beyond financial reports to examine the quality of leadership. With an LCI, they can probe the underlying leadership knowledge and skills, which gives them greater confidence in future earnings and reduces their risk.

When we started to create an LCI for investors, we wanted to take investors from 5-10% confidence in leadership to 80-90% confidence. Th is was naive. Assessing leadership is still as much art as science, but we think we can help investors get to 30-40% confidence in the leadership of firms in which they invest.

From extensive interviews with active investors, we found that most investors recognize the value of leadership, but either don’t assess it because it is not in reported income statements, or do a very narrow assessment of one or two leaders (for example, the chief executive and/or the chief operating officer) on one or two of the ten elements (for example, does the chief executive have a good track record, or a viable strategic position, or personal charisma?).

The LCI offers investors a comprehensive picture of leadership. For a firm such as Volkswagen, where leadership has cost the firm market value, investors will want to ensure that future leaders maximize all the elements of the LCI.

Boards

Boards represent investors to ensure maximum shareholder value. Th e index will help the board recognize not only the premium or discount of leadership, but the ways to improve it. In the earlier example (of the board of directors looking into reasons for their company’s low stock price), the independent adviser could stipulate that leadership is the reason the firm is being discounted against its earnings and innovation. Th e adviser could then point to specific elements of the LCI to help the board direct leadership efforts to build shareholder confidence.

Leadership development experts

In building future leadership, general managers, HR professionals and leadership experts work to build leadership that investors will value. Efforts may include hiring, promoting, training, and developing leaders. In each of these cases, a standard for improving leadership is the extent to which investors will see improvements in the ten elements of the LCI. One chief HR officer said a large part of his time was spent meeting investors to help them see the quality of leadership within the organization. The LCI would help him in these conversations.

Entrepreneurs

More than 70% of new jobs in the US and EU are created by small and medium enterprises (SMEs). Investors are increasingly investing in private equity funds to benefit from the value created by these SMEs. However, SMEs naturally off er very little historical track record for investors to use as a basis for investment decisions, leaving intangibles and the underlying quality of leadership as the key areas for firm valuation. Entrepreneurs can use the LCI to provide investors with confidence -building data that indexes the SME’s quality of leadership. Additionally, as SMEs use and track LCI data over time, entrepreneurs can show year-over-year improvements in the quality of leadership, thus increasing investor confidence further.

Further reading: The Leadership Capital Index

Dave Ulrich

$29.95