Research shows that companies with traditionalist financial bosses are the least profitable

[button type=”large” color=”black” rounded=”1″ link=”https://issuu.com/revistabibliodiversidad/docs/dialogue_q4_2016_print_proof__cropp/54″ ]READ THE FULL GRAPHIC VERSION[/button]

What kind of chief financial officer do you have at your company? Do they like to think objectively, ignoring politics and personalities? Do they prefer existing systems and processes to spearheading change? Are they efficient administrators rather than reforming strategists? If the answers to all of the above are ‘yes’ you might have a traditionalist in your midst. And the bad news is they are often bad for business.

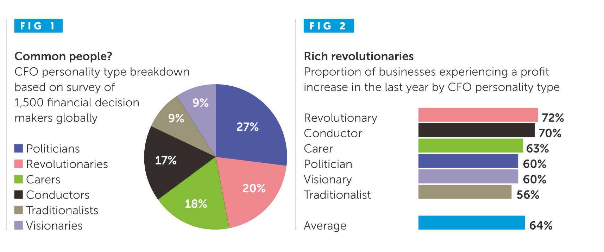

Redshift Research surveyed more than 1,500 CFOs in businesses with more than 100 employees in the US, Australia, China, France, Germany, Hong Kong, Mexico, Singapore, Sweden, UK, and Canada. A clear finding emerged. Straight-laced financial bosses tend to work in companies that are less profitable than those staffed by their modern, swashbuckling counterparts (see personality profiles).

So why is this? First, it is difficult to build strong interpersonal relationships with a traditionalist CFO, which often leads to their being bureaucratic and resistant to change.

Second, traditionalists were far less likely to use management accounting techniques than their peers of other personality profiles (28% vs an average of 39%). Management accounting is the discipline of giving advice to leaders based on the data rather than just the numbers themselves. Naturally, a lack of applied financial analysis can hamper profitability.

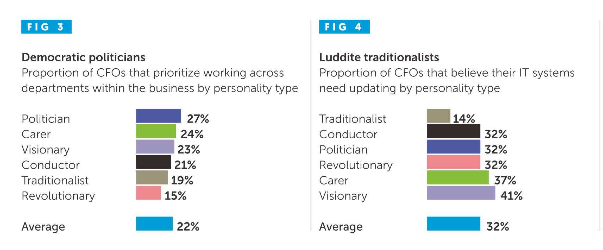

Finally, traditionalists are shunning the great help that is on offer from modern technology. There is a wealth of products out there that can help CFOs do more in their role for less time and effort. Yet not only are traditionalists more unlikely than any of their peers to believe that their IT systems allow them to do more than in years gone by (9% vs 23% of their peers), they are also the least likely to acknowledge any need to change them (14% vs an average of 32%, see graphic). Luddism, it seems, is alive and well in the world of the traditionalist CFO. “The preference for traditional CFOs to work within existing systems and disregard the need for change stems from a lack of flexibility,” says Dr Dimitrios Tsivrikos, a business psychologist at University College London. “One study has shown that flexibility plays a major role in the innovation process. Taking on new perspectives and being open to novel ways of doing things allows a person to find optimal and creative solutions to problems, which fosters innovation.”

So if traditionalist CFOs are the personalities to avoid, which are the profiles companies should look to hire? If it’s pure profitability you crave, you should seek out a revolutionary. These charismatic figures are rarely bound by corporate rules and processes, and are happy to break free of such strictures if the business demands it. As a result, 72% of them saw profits in their business increase last year, compared to just 56% of their antitheses, the traditionalists (see Figure 2).

Delve deeper into the psychology of these ultra-modern revolutionary CFOs, and something interesting emerges. They are rarely happy with their lot. Rather than accepting a company’s processes and systems as the way things are, revolutionary CFOs rail against anything that gets in their way. For example, they were the most likely of any personality type (48%) to report that the IT support they got from their company was inadequate. The data is clear: if you want a revolutionary, profit-making CFO, make sure they have the best tools for the job. “As a result of their tendency to set high targets, revolutionary CFOs are likely to be critical of any current systems or processes that hinder their path to success,” says Dr Tsivrikos. “This accounts for the finding that almost half of the revolutionary leaders believe the current IT support they receive is inadequate – they are forward-thinking and keen to explore new systems that will help them achieve their goals. And their less rigid approach leads to business success, as can be seen by the fact that revolutionary leaders are more likely to experience profit growth than their peers.”

That’s fine for those companies that are blessed with such game-changers at the heads of their finance department. But if your CFO is more of a stout traditionalist, what do you do? The good news is that people can change, with the right support.

Even in an age where technology is there to do the heavy lifting, many CFOs remain bogged down in the day-to-day morass of cost management and fine financial detail.

Automate much of this nitty-gritty, and some CFOs will escape the shackles of the traditionalist and become unbounded revolutionaries.

“Researchers have identified ways for individuals to become more flexible and adaptive, such as being open to new ideas, by accepting feedback and engaging in non-habitual behaviour,” says Dr Tsivrikos. By adapting and innovating, CFOs can avoid damaging business growth, and help improve it instead.

— Malcolm Fox is vice president of product marketing at business software specialist Epicor

— Some figures may be subject to rounding error. Profiles include Dialogue’s own analysis