ESG is centre stage in many businesses – yet many leaders are unclear about core concepts. A new framework offers clarity

Today’s businesses ignore environmental, social and governance (ESG) considerations at their peril. Changing consumer demand, investor expectations and regulatory requirements are rapidly transforming the business environment from one in which profit trumps people and planet, to one in which these exist inter-dependently and in mutual support. Yet for many leaders, ESG remains shrouded in fog. Despite sustainability experts’ best attempts to explain ESG, many business leaders still have limited clarity about what it means for their organization in practice, and what they ought to be doing about it.

Businesses with an active and deliberate ESG approach reap numerous benefits. Deloitte research in the UK found that 34% of consumers chose brands with environmentally sustainable practices or values in 2020-21, while a 2019 Schroders survey found that 61% of Generation X always consider sustainability factors when selecting an investment product. And most leaders are familiar with the power of social media to help ethically-driven movements mobilize rapidly, and to destroy business reputations overnight. Think of the impact of MeToo, or how Greta Thunberg has inspired young people around the world.

Not only does ESG performance shape how firms compete for customers: it increasingly affects their ability to compete for talent, as values-driven Millennial and Gen Z employees seek responsible, purpose-led employers with sustainable business models. What’s more, ESG metrics have been accurate indicators of stock volatility, earnings risk, price declines and even bankruptcies. According to research produced by Merrill Lynch, ESG could have helped investors avoid 90% of bankruptcies, and an investor who only held stocks with above-average ESG scores would have avoided 15 of the 17 major corporate bankruptcies that markets have witnessed since 2008. And ESG is increasingly affecting capital flows. The Financial Times reported that responsible investment funds saw net flows increase by 275% in 2020 compared to the prior year, and 2021 looks like it will beat that record. It’s clear that ESG will play a central role in markets in the near future, and access to capital for companies without good ESG credentials will be very limited indeed.

Understanding ESG metrics, data and reporting is thus becoming critical for businesses as they engage with stakeholders and attempt to meet their demanding expectations – yet a recent PwC survey found in nearly three-quarters of organizations, leaders are only “in the early stages of their ESG journey”. The report praised the record of companies such as Adobe, Salesforce, Microsoft, Procter & Gamble and Best Buy, and emphasized the importance of ESG to strategic reinvention, business transformation and reimagined reporting. Yet a lack of leadership attention or support was identified as a barrier to ESG effectiveness by 33% of those surveyed. The reality is that many leaders remain uncertain, confused or uninformed about ESG and what it means for their business.

The POPP framework for ESG

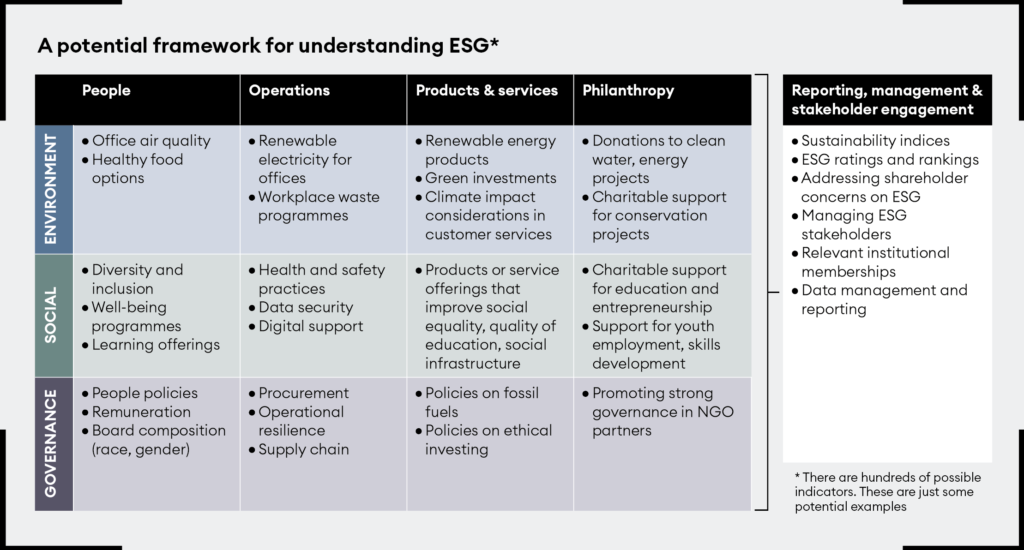

Through his work at Investec, Marc Kahn has developed a simple ESG framework that has helped leaders cut through that uncertainty and confusion. He had found that many people were making the mistake of thinking that Environment means climate; that Social means people; and that Governance means compliance. Those oversimplifications are ultimately incorrect. The misunderstanding was causing confusion and misalignment between leaders, and leaving members of the sustainability team frustrated. Kahn’s framework addresses this by capturing the intersection of ESG with People, Operations, Products & Services and Philanthropy (POPP).

The framework helps to determine ‘what goes where’ in relation to ESG. People relates specifically to the organization’s people – primarily employees. Operations refers to the company infrastructure. Products and Services relates specifically to the company’s customer value proposition, the value-creating activity at the heart of the business model, in contrast to Philanthropy, which covers charitable and non-profit activities. The examples in the framework above show how ESG exists across these columns.

What goes where

With clarity about POPP, we can plot how a company’s activities sit in relation to ESG. For employees, Environment includes things like air quality and healthy food options in the workplace: this is the ‘E in People’. The ‘E in Operations’ includes using renewable energy for office spaces. When it comes to Investec’s products and services, relevant activity includes its investment products in the renewable energy sector – while the ‘E in Philanthropy’ includes initiatives to support community waste and energy programmes. This may look like a social initiative, but what matters is the underlying driver – here, the environment.

For the social dimension, we could look at an organization’s diversity, wellbeing and learning programmes. The ‘S in Operations’ would include things like data security and digital support. Relevant products and services at Investec include the Global Sustainable Equity Fund, which seeks to provide investors with capital growth over the long term by identifying investments with strong social characteristics. As an example: Investec is an equity partner in the Invictus Education Group in South Africa, which has enrolled over 20,000 students in its programmes and is making a significant contribution to the country’s skills development. This is not philanthropy – it is a business venture, but one with an explicit social purpose.

Governance spans all four parts of the POPP framework. The ‘G in People’ includes the company’s people policies, remuneration practices, and its board composition; metrics might include those for diversity. Operations would include procurement policies and practices, operational resilience and supply chain policies. For Investec, relevant products and services include its ESG lending policies and screening – such as policies on the fossil fuel and defence sectors, while the Philanthropy box would include Investec’s work to promote good governance among its NGO partners.

ESG has the potential to drive greater business profitability and improved outcomes for society. This framework shows that ESG gets to the very heart of business, revealing how leaders deliver value for all their stakeholders in our fast-changing world.