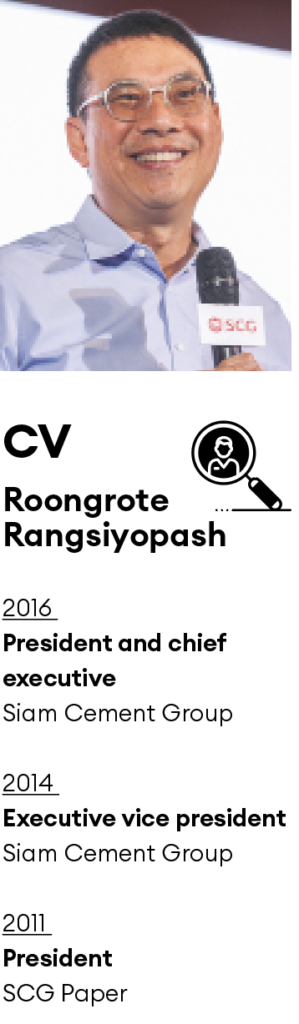

Roongrote Rangsiyopash epitomizes the modern leader.

It was 1997 when it became clear that the numbers didn’t add up at SCG’s ceramic tile plant in Tennessee. “The company’s total sales were around $120 million and we had $140 million in loans – that was a big amount that we could not pay,” recalls Roongrote Rangsiyopash, president and CEO of Siam Cement Group (SCG). “I had to go back to Thailand to get some financial help from the parent company so that I could refinance.”

At the same time, though, the board was contemplating a strategic exit from the ceramics business in the US. “There were too many of these things going on,” says Rangsiyopash. “It wasn’t easy managing our financials in parallel with managing the huge amount of debt, and selling the company all at the same time.” Eventually, the sale was made. “It took us about three years before we finally sold the company to our partner from Italy,” recalls Rangsiyopash.

It is a tale of success through crisis, delivered by a young man with limited experience in turning companies around.

Lessons in real life

Just ten years earlier, in 1987, Rangsiyopash had joined SCG Group as an engineer. He later worked in sales – “which I enjoyed very much” – before the conglomerate put him through an MBA scholarship in the US. During his time there, Rangsiyopash did fieldwork at the Tennessee ceramics firm.

“I was only 31 at the time and working seven days a week,” he says. “Our plant couldn’t compete on cost, so we decided to double our production capacity to bring unit costs down. That was a mistake, because you never make a company competitive by doubling capacity. You make a company competitive and then you would double the capacity. That was my first lesson – but I had no choice because, by the time I arrived, the company had already expanded, and I was assigned to manage everything.”

Initially, Rangsiyopash was able to secure the bank pledge to renew the $140 million loan, provided he and existing management remained at the helm. But that was in 1997 at the start of Asia’s financial crisis, which caused the bank to renege. “The board of the bank decided against the recommendation,” recalls Rangsiyopash. “All loans to Asian companies were recalled. So that was the beginning of our restructure. We had no choice. I had nowhere else to go.”

Faced with both a deep internal and external crisis, Rangsiyopash felt isolated, underprepared. “All I had was the MBA texts I had learned as a student – ‘How to Get Out of Chapter 11’”, he recalls. “But real life is very different from what you read in a book. It’s very different living day-to-day. And you get angry because there are lots of things you cannot control. In the first moment, you think ‘I’m okay for two years, I have the renewal of the loan.’ Then in the next moment, you discover, ‘I am going to have to find refinancing.’ Those were moments and situations which are not taught in MBA classes.”

What Rangsiyopash learned from the repercussions of the Asian financial crisis – and how he overcame them – offers lessons for leaders facing multiple external threats. After the brutal period of refinancing, he evolved from a defensive posture, through a turnaround position, and into one of a growth mindset. He ascended to chief executive in 2016. By 2020, the company’s revenue had reached almost US$11.5 billion, with a workforce of more than 53,000 people.

“I think the first lesson, if you want to survive a crisis, is to up your game and fight,” he tells Dialogue. “If you lack passion, you won’t be able to overcome a crisis.” His ability to connect and communicate with people is key: “You must ensure people understand the situation, understand all the ramifications, and understand the path we have decided to take.”

He recalls the torment of the recent pandemic and what it took to guide SCG through a period when the world had shut up shop. Rangsiyopash decided to focus less on the construction crunch and more on his people. “There are some crises where you simply don’t know how you are going to get out,” he says. “With Covid, all you knew was that people were going to die.”

When crisis causes fear, the terror that ensues can double the jeopardy, rendering a dangerous situation a lethal one. “Imagine you go to the theater and there is a fire,” says Rangsiyopash.

“If everyone leaves that theater in an orderly manner, they will be okay. But if people are afraid, people will die from the chaotic panic where they trample each other.” Is that paradox at the heart of leading in crisis? “Yes,” he says. “The most important part of a CEO’s job is to preserve the positive human spirit.”

Does that positivity, that inner calm, start with the person at the top? “You should never pretend that everything is business as usual when it isn’t,” says Rangsiyopash. “You must explain that it is a crisis. But you must also have hope – a little more hope than the rest of your people.”

Building the future

SCG operates in a world where environmental threat is rapidly becoming a commercial threat. Environmental, social and governance (ESG) measurement, he says, is becoming a core metric for the company. It seeks to operate as a positive force when global resources are under pressure.

“When King Rama VI founded SCG 110 years ago, the original idea was to develop a better society,” he says. “That was the original idea – not cement, but the modernization of Thailand.” Navigating a path towards net zero, he suggests, is the contemporary incarnation of that societal goal.

SCG is the first company in Thailand to have been included in the prestigious Dow Jones Sustainability Index. It has remained in the index every year since 2004. Yet I sense this is insufficient for Rangsiyopash. “Net zero is a pressure, but we must become part of the solution,” he says. In the fall of 2021 Rangsiyopash attended COP26 in Scotland. The impact on SCG was immediate. “COP was a good experience,” he says. “Straight after it, we announced our ESG pathway. That is now our bible in terms of our path towards net zero.

“ESG is going to become a key part of our business”, he adds. “You look at sales, you look at profit, you look at your market cap. In the next five to ten years, our ESG scorecard will be even more important.” SCG is moving in the right direction, he believes. “I’m pleased with the progress our group has made toward decarbonization and net zero transformation,” he says. “We have come a long way.”

Climate change will remain the greatest human challenge of our time, he believes, yet it is far from the only challenge we face. Geopolitical threats – for example the war in Ukraine and tensions between China and the US – and the march of technology conspire to render black swan events not isolated, but convergent.

“I was listening to President Biden a week ago,” recalls Rangsiyopash. “He said that one thing is very important: how to govern AI. I don’t know how that became the number one priority for the US President. But if that is correct, then that should be on the top of the list for SCG as well.”

Rangsiyopash is now an elder statesman of the industrial space, a learned leader and visionary. He will step down at the end of 2023, after a lifetime of service to Thai industry. As his valedictory has grown closer, he has developed a profound spirituality. “I’ve started to learn much more about religion,” he reveals. “I started studying Buddhism 13 years ago, and it made immediate sense to me. I enjoy it and try to study as much as time allows.” Were he not at SCG, he says, he could imagine himself as a “full-time student of religion”.

He is clear, too, about the need to balance work with other activities, allowing one element to complement the other. “In the old days, I didn’t need to recharge a lot,” he says. “But once you get older, you must recharge. Listening to music, playing golf, just enjoying exercise, doing different things from your day-to-day routine.”

And it’s working. Rangsiyopash retains a palpable energy in his final months at SCG. I ask him how the role of chief executive has changed compared to five or ten years ago. “Leaders today have to be more aware,” he says. “Whether it is energy costs, the freight situation, the way the war in Ukraine is changing the dynamic of supply and demand – unless you are a tiny local company, you must pay close attention to what is happening in the world.”

Chief executives also need to be relentlessly focused on the future. Take the forthcoming leadership handover. “This transition is a result of the succession plan that we started about eight years ago, just prior to my appointment as the CEO of SCG”, he explains. Chief executives should take ownership of the succession plan for all key senior executives. “Planning should start at the point when he or she assumes the CEO position.”

His role has evolved again in his final months in post. “For the past eight years, my focus has been on how to make the company better, grow faster, more competitive and more innovative,” he explains. “Now, my focus has shifted onto how we give room for the new management.” He leaves with a sense of confidence about SCG’s trajectory and its ability to meet challenges like net zero. “I believe that our group is on the right path,” he says. “The new CEO and his management team are well equipped to take our group toward the transition and transformation that are required for a prosperous future.”

Great leaders shape their companies’ destinies. “CEOs must pay heed to the future,” says Rangsiyopash. “Of course, we cannot predict it. But we must try to see its possibilities.”

Vishal Patel is president of global markets at Duke Corporate Education.