Laying the groundwork for a more sustainable way of doing business means integrating ESG with digital transformation.

The financial value of a company is no longer the only concern of stakeholders. Today, they are just as interested in the values a company holds. Purpose has become a priority, and in a rapidly-changing social and environmental climate, organizations can’t afford to make the wrong assumptions and fall behind.

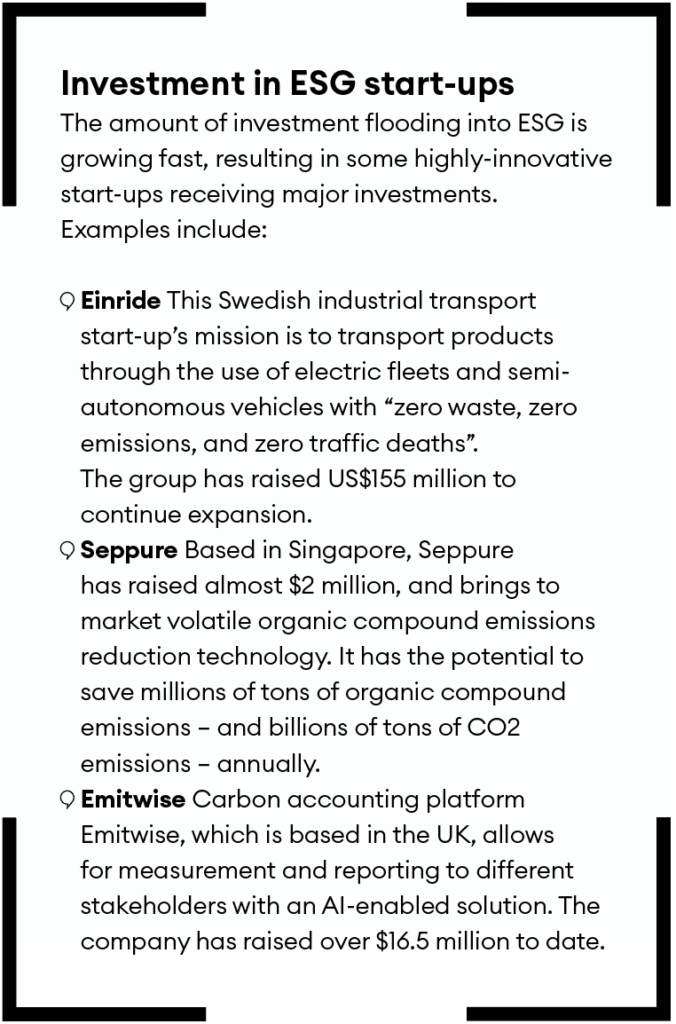

Environmental, social and governance (ESG) investing – including thematic funds, investments within enterprises, and start-ups – has never been so popular. But that popularity brings complexity and some pushback. The noise surrounding ESG has reached almost deafening levels.

Thankfully, with the right leadership and mindset – including, critically, an understanding of how to lay the digital foundations for ESG by integrating ESG and digital transformation strategies – organizations can cut through the din. They can simultaneously deliver on ESG targets and deliver improved financial performance.

Making sustainability strategies sustainable

Sustainability matters. According to LEK Consulting’s 2022 Consumer Sustainability Survey, over 50% of consumers are now prepared to pay for more sustainable products.

Many large public companies now release ESG reports alongside their annual reports, and in the US, the Securities and Exchange Commission (SEC) may soon mandate certain ESG disclosures. Meanwhile, the European Banking Authority (EBA) announced at the end of 2021 that the top 150 banks in the European Union will be required to publish KPIs for ESG, beginning in 2024. These sustainability indicators include a green asset ratio (GAR) showing a bank’s ‘green’ assets as a proportion of total assets and a banking book taxonomy alignment ratio (BTAR) which measures how a bank’s activities contribute to EU climate goals – including how climate-friendly their clients’ businesses are. This mandatory reporting will place additional pressure, not only on banks, but on other types of companies operating in the EU.

Such emerging regulations contribute to the increasing requirements for ESG compliance. Demand from financial powerhouses like BlackRock, Vanguard and Fidelity further bolster its importance, with global ESG assets expected to represent more than a third of the $140.5 trillion in projected total assets under management by 2025, according to Bloomberg Intelligence. Increased transparency is also being created by non-profits like Net Zero Tracker, which help shine a light on firms’ performance.

But there has been an inevitable backlash on ESG: from some investors, small business leaders and others who have challenged ratings agencies’ authenticity, and from some politicians and climate activists. One cause of the backlash is purely economic: the cost of reaching net zero is daunting. If the world is to achieve this goal, around $275 trillion of investment is required by 2050, or $9.2 trillion per year, according to McKinsey’s estimates. For context, the entirety of global GDP was $94 trillion in 2021. As another economic recession looms, this price tag looms very large.

Another part of the cause is simply that backlash garners political headlines. Some politicians question “woke” investors, while climate activists complain that companies and funds are “greenwashing” – promoting their climate credentials without actually delivering much positive change. (InfluenceMap analysis suggests that 71% of ESG funds currently fall short of the standards set by the Paris Agreement goals.)

That all makes for a significant amount of noise around ESG. How should businesses move forward? The simplest path is to anchor sustainability strategies to growth and operating performance in a way that renders the noise in the system mute. That means executing ESG strategies that deliver business performance benefits, not just compliance. Integrating an organization’s ESG and digital transformation strategies is key to answering the question: how do we make sustainability sustainable?

The benefits are clear. For example, Just Capital reports that the top 100 most just companies use 19.8% more renewable energy and were 6.8 times more likely to disclose pay gap analysis than their peers. They also created 7.8 times more jobs in the US, enjoyed a 4.4% higher return on equity, and paid 19.2% more in dividends. Investors also recognize the extensive research now showing better financial performance among companies that value good governance, diversity, environmental compliance and climate planning.

The digital revolution parallel

One powerful way to address this complexity is to integrate digital transformation strategy with ESG, using new technologies to make material improvements to business and operating models. Nearly every aspect of an operating model can already be addressed with digital technologies that deliver ESG benefits.

Organizations require advanced data capabilities to understand their current ESG scores. They also need digital solutions and new technologies to make the operating changes which improve ESG performance – and data-driven reporting solutions that support transparency and traceability, to communicate progress towards goals. As Jay D Miller, chief executive of Nortech Systems, says: “The relationship between data and digital and sustainability is absolutely intimate, they go hand-in-hand.”

Established technologies including internet of things (IoT) and artificial intelligence (AI), as well as the rapidly growing climate tech sector, help businesses to optimize, automate, improve value chains and business practices, and reduce resource consumption. These technologies can

and should be directly utilized to advance sustainability initiatives.

Around the world, more and more established organizations are showing the way. The Secretariat of Finance in the State of Mexico, for example, uses blockchain to provide transparent data on its ESG bond, worth over US$100 million. That includes funding recipients, project summaries, and transparent reporting of the ESG benefits targeted and realized by the bond. Meanwhile, water purification company EcoLab provides its customers with a calculation of what it calls ‘eROIsm’, which quantifies the value of the improved performance, operational efficiencies and sustainable impacts achieved with its technology solutions.

There is also a shift under way as manufacturers replace older materials with materials that are much more sustainable. As Miller explains: “Companies want products that are higher-performance, lighter, lower cost, and have a much smaller carbon footprint. That it is possible to deliver this as well as provide advanced data connectivity through materials that are tens of thousands of times less carbon intensive is incredibly valuable.”

Britt Ide, director with Northwestern Energy and Atlis Motor Vehicles – a company pioneering new battery chemistry to accelerate the transition of multiple industries from traditional fuels – describes the integration of digital and ESG as fundamental to strategy. “Change, innovation, disruption, ESG – all of these fundamentally include technology. Leaders need to ask, ‘What’s coming next?’”

Reaping the talent reward

Deployment of digital solutions for ESG has a further, perhaps unexpected benefit: driving talent engagement. Jan Walstrom is the senior vice president, office of global climate response & ESG and head of enterprise risk management at Jacobs, whose mission is to “make the world smarter, more connected and more sustainable.” The company has been named to the Dow Jones Sustainability World Index. Walstrom explains how Jacobs works at the intersection of ESG and digital. Examples of its work include using digital technology to unlock roadway congestion and create electric road charging, transforming the world’s largest bus fleet to become a true electrified scheme, and using sensors, embedded systems and real-time data that allow water-system operators to optimize systems and chemical usage, and reduce costs for communities impacted by flooding. “It is extraordinary what we can do when we have enough insight from an engineering perspective about how a system is supposed to operate, how it’s actually operating, and what levers can be pulled in operations to improve. We could not do this without the technology,” says Walstrom.

She describes the intersection of digital and talent as essential. “We enable our people to connect the job they are responsible for with how it intersects with impacting the world. Data is absolutely fundamental to how we do that, providing better insights allows people to make an immediate impact.” This is a relatively recent development. “We didn’t have such accessibility to data and insights years ago.” That has coincided with a push for change from younger employees. “Younger generations demand we accelerate our actions”, says Walstrom.

Given that a variety of technology solutions already exist in the market, how should organizations get started? It begins with mindset.

Shifting the mindset

“People are going through a mindset shift that is as extraordinary as the shift the world is going through in the energy transition,” says Jan Walstrom. Leaders around the world face the challenge of establishing this new mindset in their organizations – and they should not underestimate the challenge that rewiring established mindsets represents. The pace of change is in some cases dramatic, adds Walstrom. “In a matter of months and years people have had to unlearn, relearn and arrive at the forefront of these new opportunities.”

There are four behaviours which leaders can adopt to drive this mindset shift.

1 Set a bold vision which integrates digital transformation and ESG with the organization’s core strategy. This vision should go beyond the walls of the enterprise to also include Scope 2 and 3 emissions (those it is indirectly responsible for in its operations, and those emitted by suppliers and customers using the company’s products) to account for full value chain impacts. Britt Ide describes the strategic challenge as blending the immediate product performance that customers demand with new capabilities. “This is fundamentally about diversity of thought. Open-mindedness is the biggest thing: how do leaders think about what else is out there, what can we learn from different industries?” These new technology capabilities also give leaders an opening to rethink their business models and solutions. “We can start over,” says Ide. To anchor and align ESG with financial performance, organizations may also assign ESG responsibility to an officer who is responsible for its financial performance metrics.

2 Invest in new inclusive technology solutions and communicate how these deliver progress on ESG goals as well as financial performance.

3 Engage all levels of the organization to create a common understanding of the relationship across technology, ESG and financial performance; from the board and management, to new employees to suppliers and investors. Nortech, for example, collaborates with both customers and suppliers on ESG. “We are working to make positive ESG impacts across the board, through Scope 3 reporting. We engage other companies to work on this proactively together,” notes Jay Miller.

4 Finally, communicate progress transparently. Regularly communicate successes, where there are gaps, and progress toward goals. Jacobs tracks and reports on more than 250 individual ESG metrics, which Walstrom describes as “very intensive”, requiring “advanced data and digital enablement”. Ide also suggests extending engagement to new employees as they are onboarded: “Share with them why are we thinking about digital transformation, ESG and how they connect. There is a huge opportunity to show that the organization is working on these topics, and ask them to contribute.”

ESG and digital transformation belong at the heart of an organization’s strategy. By setting a bold vision, exploring new digital technologies, and creating a new mindset, leaders can accelerate both financial and ESG performance while enabling their enterprises to deliver a broader purpose.

Ryan McManus is an educator for Duke Corporate Education, board director, and the founder and chief executive of Techtonic.