In the digital era, leaders need strategies that place technology alongside environmental, social and governance risk factors. Andrea Bonime-Blanc explains

What does it mean to be a transformational digital leader during the perfect storm of systemic risk we are living through? At a time when several environmental, social and governance (ESG) crises of mega proportions are under way and overlapping: climate change, the pandemic, the future of work, corporate racism, flawed corporate and international governance? When cyber and social media attacks of all kinds are rising? At a time when only the fittest survive in business – and when the meaning of the ‘fittest’ is shifting quickly, thanks to digital innovation?

In the face of the storm, it is essential for leaders to ask themselves how they can go beyond just surviving, to thriving. Developing and successfully implementing a digital-forward strategy in this ‘mega-change’ era of overlapping crises demands a new approach from leaders. In addition to knowing everything that one normally needs to know about one’s business, products, services, people, operations, strategy and tactics, leaders now must also be versed – indeed, be expert – in the identification and integration of all key and relevant ESG and technology risks and opportunities.

ESGT – which adds technology to the commonly-used ESG – is a term I coined in my recent book, Gloom to Boom: How Leaders Transform Risk into Resilience and Value, and explained in a World Economic Forum’s Agenda piece (‘It’s time we added a letter to ESG. Here’s why’ – weforum.org). The nub of my thesis is that the business (and other) leaders that will succeed in a world of myriad challenges are those that fully understand their ESGT context. Such leaders have the tools needed to develop situational awareness: to understand the risks and opportunities that will confront, challenge, impede, propel, distort and ultimately enable (or render useless) their core business strategy.

Why ‘T’?

Why is a concerted ESGT strategy, incorporating technology, so important now? Because both digital risks and digital opportunities are multiplying from day to day. Just think of how technology has interacted with other dynamics during the pandemic. On the one hand, global scientific collaboration is happening at unprecedented scale and speed, and at multiple levels, enabled by digital communications. On the other, nation-state and criminal bad actors have been emboldened to attempt theft of pharmaceutical companies’ intellectual property, and to disrupt vaccine and treatment supply chains. Skyrocketing ransomware attacks are targeting the most vulnerable, including hospitals and healthcare. Meanwhile, the dark web, deep web and social media are infused with fake information about vaccines, propagated by bad actors with the intention of creating chaos, instability and death.

Each of these risks elicits a broad variety of opportunities to the digitally savvy business. They are not standalone but intricately interconnected. Leaders must consciously and conscientiously evaluate them, and integrate them into their business strategies. Like a four-part Venn diagram, environment, social, governance and technological risks are increasingly overlapping.

Technology’s potential

The interconnectedness of ESGT risks is illustrated by a case study on the potential for AI-piloted drone ships being used in fishing – or rather, misused, wiping out a large proportion of global fish stocks (a scenario considered in the World Economic Forum Global Risks Report 2018).

First, consider that a third of the fish consumed globally are already caught illegally. Add in automated fishing technologies, and illegal fishing could have a devastating impact on fish stocks, particularly in international waters where oversight is weak. That could engender cascading failures across marine ecosystems. Communities reliant on fishing for their incomes might struggle to survive, leading to fiscal pressures and even displacement. A surge in the supply of fish might distort global food markets, leading to disruption in the agricultural and food-production sectors. And if illegal drone fishing was to cross national maritime boundaries, and was perceived to be state-sanctioned, retaliatory measures might lead to diplomatic or military tensions.

What could be done about this risk? Better vessel observation might prevent some illegal fishing. Targeted schemes such as genetic markers that enable fish to be tracked throughout the supply chain might limit demand. But key to progress in this and similar areas of hybrid technological disruption will be new global governance norms and institutions, focusing in particular on protecting the global commons and preventing the destructive deployment of emerging technologies.

ESGT and strategy

How do digital leaders – both management and board – incorporate key ESGT considerations into strategy? The following three steps are essential.

1 Situational awareness: understand the key megatrends of our turbulent times

If leaders are to do a good job of understanding their business’s ESGT risks, both executives and board must have a good, or great, understanding of the context. Ask: “Where are we on the global, large-scale changes taking place around us?” The context as I see it in 2021 consists of the following five megatrends.

1 Tech change at the speed of light

We continue to careen past the stars of technological change and digital transformation. There are great opportunities to find solutions quickly, like the unprecedented speed of Covid-19 vaccine development, but there are also risks that we forget – key ethical, social and safety measures. We need to keep our eyes on the ethical ball while making speed-of-light innovations. The EU’s work on AI ethics and fundamental rights aims to do this. In a recent report, it identified a variety of serious challenges affecting individuals and society that relate to the design and integration of AI in a wide variety of services, from predictive policing to medical diagnoses. The report suggests a gamut of legislative and other solutions, from anti-discrimination and social justice measures, to providing rights of individual redress and social oversight. Where the EU is leading, other regulators and governments are likely to follow.

2 Leadership and declining trust

As the Edelman Trust Barometer has documented for over a decade, there has been a marked decline in public trust in major institutions, including business, media, government and not-for-profits (although business appears to have recently regained a modicum of trust). The jury is out as to why, but suffice to say that a much larger burden exists on business – and business leaders in particular – to do the right thing by their stakeholders as a whole, not just shareholders.

3 The continuing rise of complex interconnected systemic risk

It’s simple: complex interconnected systemic risk is on the rise, as very ably documented from year to year by the World Economic Forum’s Global Risk Reports. These reports identify five major categories of systemic risks: economic, geopolitical, social, environmental and technological. In 2020, for the first time ever, the top five most-likely systemic risks were all environmental. This trend will continue, and so will the prominence of associated risks like pandemics and infectious disease outbreaks, and cyber attacks. Businesses cannot stand still and wait for crises to happen. To survive and thrive, they need to get ahead of these complex, interconnected curves.

4 Global geopolitical tectonics continue to shift

If you hadn’t noticed, geopolitical change is everywhere. It is evident both at the national level, with a decline in democracy worldwide recorded in the past decade, and at the level of international governance – witness challenges to the World Health Organization in 2020. The Trump era’s disruption of the post-WWII international governance order may not continue under the Biden administration, but there is no doubt that we are living in a different world where China, the EU and other notable nation state actors have a variety of powers, both physical and digital, to either disrupt or enable global peace. A disturbing report from CrowdStrike has shown that ransomware and other cyber attacks soared during the pandemic.

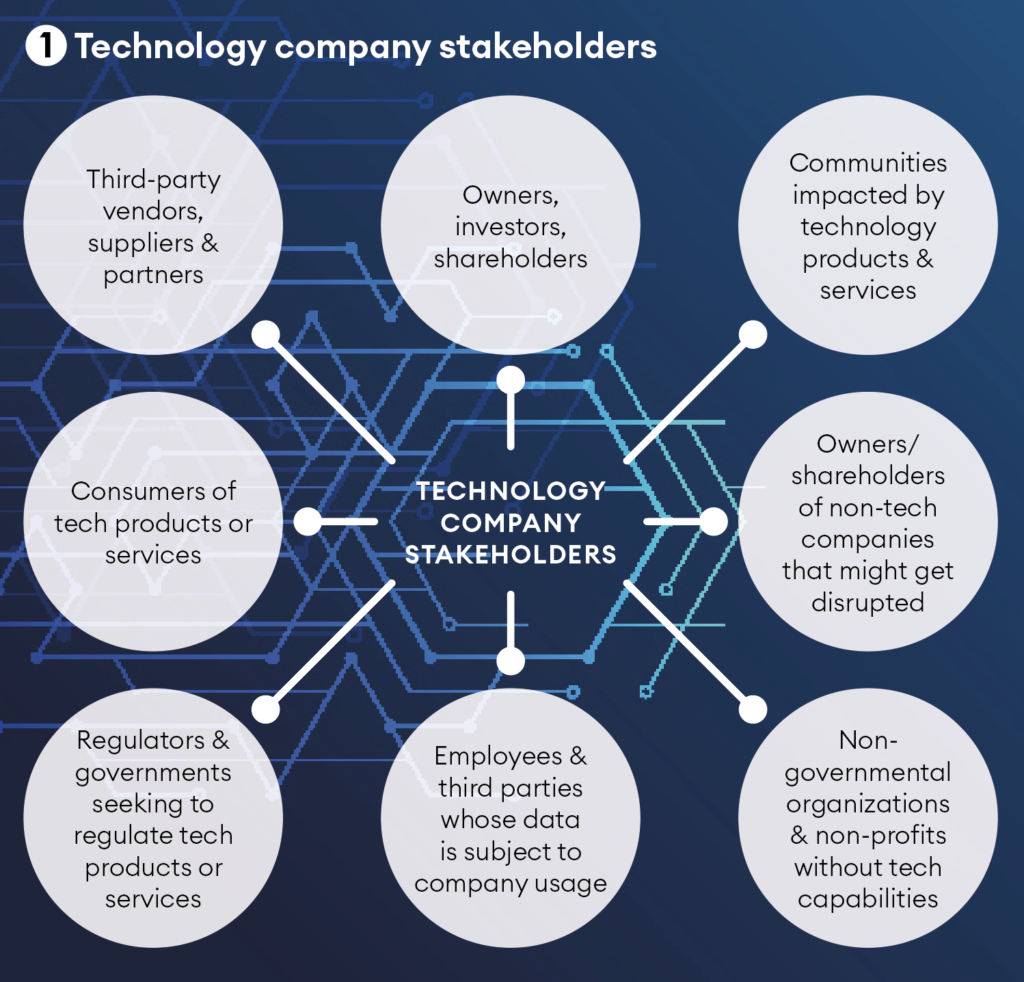

5 The rise of stakeholder capitalism

The rise of ESG, broad sustainability concerns and what some call ‘stakeholder capitalism’, as opposed to narrow shareholder-focused capitalism, is not just here to stay – it is set to accelerate. It will become critical to not only cater to and understand your shareholders and owners, but other key stakeholders too (see Figure 1). Just Capital’s corporate rankings and reports are a great resource for assessing the rise of key stakeholders in global business and their issues.

2 Create an ‘ESGT rapid deployment force’ of interdisciplinary experts

Situational awareness is increasingly necessary for leaders to run a business successfully, but resource constraints can make it seem impossible to develop that awareness in all the employees who might need it. However, I have worked on, in, or for every size of business, from start-ups to those with 100,000 employees, and it is always possible to customize an approach to key ESGT issues. Where there is a will, there is a way, and necessity is the mother of invention.

In one of the companies where I served as a senior executive, we created an interdisciplinary team of 14 people – ranging from very senior, like the general counsel and chief financial officer, to quite junior but still expert (employees specializing in key issues and risks including anti-corruption, anti-fraud and export control). The team’s overall focus was on an annual enterprise risk management exercise, but its work didn’t stop there: it went on to improve internal reporting to management, as well as external reporting, as the firm was publicly listed. Key to the team’s success: the fact that its members were drawn from functions across the business.

3 Match ESGT issues and risks to opportunities and value creation

With situational awareness and a clear understanding of their context, businesses can gauge how their ESGT weaknesses, strengths, risks and opportunities can translate into actual business value-creation and innovation.

The Big Data for Sustainable Development site, produced under the auspices of the UN’s Sustainable Development Goals (SDGs), is a great place for responsible and enlightened business leaders to find inspiring examples (see bit.ly/SDGsBigData). It is absolutely possible to do good and do well simultaneously. There are great business opportunities in the private/public partnerships which are an intrinsic part of the UN SDGs, and in tackling rising environmental risk. It has been projected that there are at least $26 trillion of opportunities in climate change-related business over the next decade.

The challenge for leaders

The three steps outlined here provide high-level, actionable guidance to boards and executive teams for creating the transformative framework necessary to survive and thrive in today’s mega-change environment. It is the basis for innovation, for the products and services needed for successful change, and for catering to key stakeholders in the larger framework of our movement toward stakeholder capitalism.

The mega-change era isn’t ending anytime soon. Indeed, it is likely to accelerate substantially. Leaders must buckle up and deploy a smart ESGT strategy to avoid being disrupted and replaced.