The world’s first social stock exchange is set to change how we do business, writes Professor Durreen Shahnaz

[button type=”large” color=”black” rounded=”1″ link=”http://issuu.com/revistabibliodiversidad/docs/dialogue_10_q1_2016_full_book/54″ ]READ THE FULL GRAPHIC VERSION[/button]

Traditional capitalism is outmoded. The first stock exchange was started in the 1500s in Antwerp, Belgium, by a group of brokers and money-lenders who would gather to deal in business, government and even personal debt matters. More than 500 years on, we are still running on the same wheel, albeit on a different scale. The results have been astonishing.

In the past century alone, gross world product has increased nearly 70 times from $1 trillion in 1900 to more than US$70 trillion today. Capitalism as we know it has been efficient in maximizing profit, resulting in empires of extreme wealth for some. Yet, it has largely failed to deliver prosperity to everyone else.

Despite the wealth of capital created, more than two billion people in the world still suffer multi-dimensional poverty – deprived of nutritious food, clean water, basic sanitation, healthcare and energy.

How to maximize value over profit

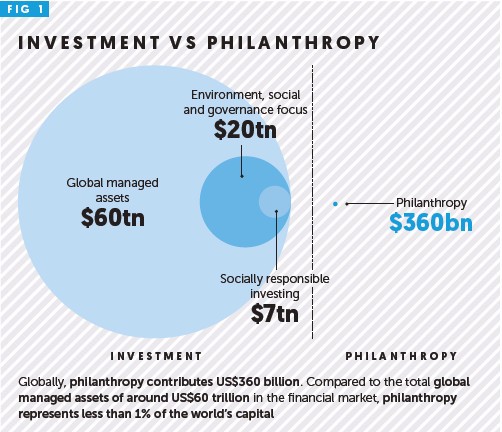

Within this narrow profit-maximizing paradigm, we have been wrongly separating profit from value. We look to philanthropy to solve some of the world’s most pressing problems, when its contribution to the global financial market is but a drop in the ocean. Consider this: globally, philanthropy contributes $360 billion today. Compared to the total global managed assets of around $60 trillion in the financial market, philanthropy represents less than 1% of the world’s capital (see figure 1).

While philanthropy remains a critical player in the path towards sustainable and equitable development, the time has come to see beyond these binary paradigms. In order to draw closer to the universal value of achieving prosperity and security for all, we must harness the power and the scale of the capital markets, together with the social consciousness of the philanthropic sector.

The world’s first social stock exchange

A third way is necessary, and it is being etched out through the impact investing movement. Impact investment – investment intended to create positive social impact beyond financial returns – combines the efficiency of the free market with the higher mission of philanthropy and development. By marrying finance and development, we can reach a vibrant marketplace that brings together investors, entrepreneurs, and the entire financial ecosystem, to embrace social and environmental returns, as well as financial returns.

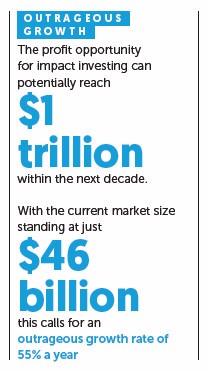

The two companies I founded – Impact Investment Exchange Asia (IIX), and its non-profit sister organization, Shujog – were created to catalyze the impact-investing movement. According to a recent report by JP Morgan Global Research, the profit opportunity for impact investing could reach $1 trillion in the next decade. With the current market size standing at just $46 billion, this calls for an outrageous growth rate of 55% a year.

IIX’s Impact Exchange is our response to the call for outrageousness. The Impact Exchange is the world’s first social stock exchange, and is dedicated to becoming a global marketplace for connecting impact enterprises, or enterprises with high social impact, and social impact funds with mission-aligned investment. The Impact Exchange, now regulated by the Financial Service Commission in Mauritius, provides a unique opportunity for impact enterprises to raise investment capital to scale and deepen their social and environmental impact. At the same time, it offers impact investors the opportunity to invest in, and trade securities issued by, organizations that reflect their values.

Its first product is the Women’s Livelihood Bond (WLB) (see right), a $20 million debt security designed to empower more than half a million women living in the most vulnerable communities in Asia to shift from subsistence living, and towards achieving sustainable and resilient livelihoods. Starting with the WLB, the Impact Exchange sets out to float other innovative financial mechanisms to connect the worlds of finance and development, and to pave the way for the future of capital markets for social good.

It is simply not enough to jump on the bandwagon. To cut through the new terrain and achieve the universal ambition of prosperity for all, we need to reinvent the vehicle. The world’s first social stock exchange is the glitzy vehicle of choice, and we’re putting women in the driving seat.

Professor Durreen Shahnaz authored the piece with assistance from Lim Jia Ling, advocacy, IIX and Natasha Garcha, business development, IIX