When consumers are under pressure, retailers need to focus on their customers, rather than rushing to make across-the-board price cuts.

The global business landscape has been hit hard by inflation in the wake of Covid-19 and the war in Ukraine, and some economies are teetering on the edge of recession. Such uncertainties do not come with a handbook – no two downturns are exactly the same – so business leaders must brace for a bumpy ride ahead. That often takes the form of cost-cutting and a highly cautious approach to new investment, particularly in retail, as leaders seek to buffer their businesses against the poor economic climate. Marketing and communicating to customers are often first under the knife.

Yet that may be a mistake. Thanks to digital technology, marketers now have the tools at hand to shift strategy away from indiscriminate cost-cutting, to more productive areas of focus. We can turn to data to better understand what matters most to our customers in tough times.

Granularity matters

First, let’s examine decision-making during a recession. The margin for error is reduced as businesses cannot afford to make any mistakes, which there may be room for in a healthier, growing economy. This is when data granularity comes into play. Businesses need to collect data at a level of detail that allows them to understand the specific drivers of their business, and to track these drivers over time. By doing so, decision makers can gain insights into which areas of their business are most vulnerable to economic downturns, and develop strategies to mitigate these risks.

For example, retailers that collect sales data at a high level of granularity (such as by SKU number or by store) can identify which products or locations are most impacted by economic trends. This information can then be used to make decisions about which products to discount, which locations to close, or where marketing spend can be allocated. Without this level of detail, businesses may make decisions based on incomplete or inaccurate information, which can lead to costly mistakes, or worse, missed opportunities.

Focus on individual customers, not cohorts

Next, we need to look at how businesses treat their customers. As customers become more price-sensitive, businesses are competing for every penny. A common approach is discounting products across the board. However, this can prove short-sighted. It all comes down to how businesses are slicing up their data. Too often, we see businesses make decisions based on the average of a cohort of customers, rather than focusing on the journey of individual customers. Poorly performing products and services are hidden behind the average, and businesses miss opportunities to engage with their most high-value customers.

In the world of retail, the traditional approach to decision-making might have been to look at geographic segments, product lines or channels independently, asking questions like: “How is the London store doing?”, “Is the new range performing?” or “How are online sales doing vs store sales?” Today, the customer journey is not so simple. Customers are not restricted to a single channel or a single geographic region: a customer based in New York could visit a store in London while on holiday, physically try on a jacket, and then purchase it online when back home. When brands have the ability to track this journey and understand when and how a customer makes their purchases, they’ll be able to make more meaningful customer-centric decisions on when to apply discounts that matter, and which channels to use when communicating with consumers.

Look for pricing opportunities in new markets

Investing in entering new markets during a recession may not seem like an obvious choice when times are tough. However, it is a strategy that can help businesses diversify their revenue streams, reduce their dependence on a single market and buffer against volatility in the global market.

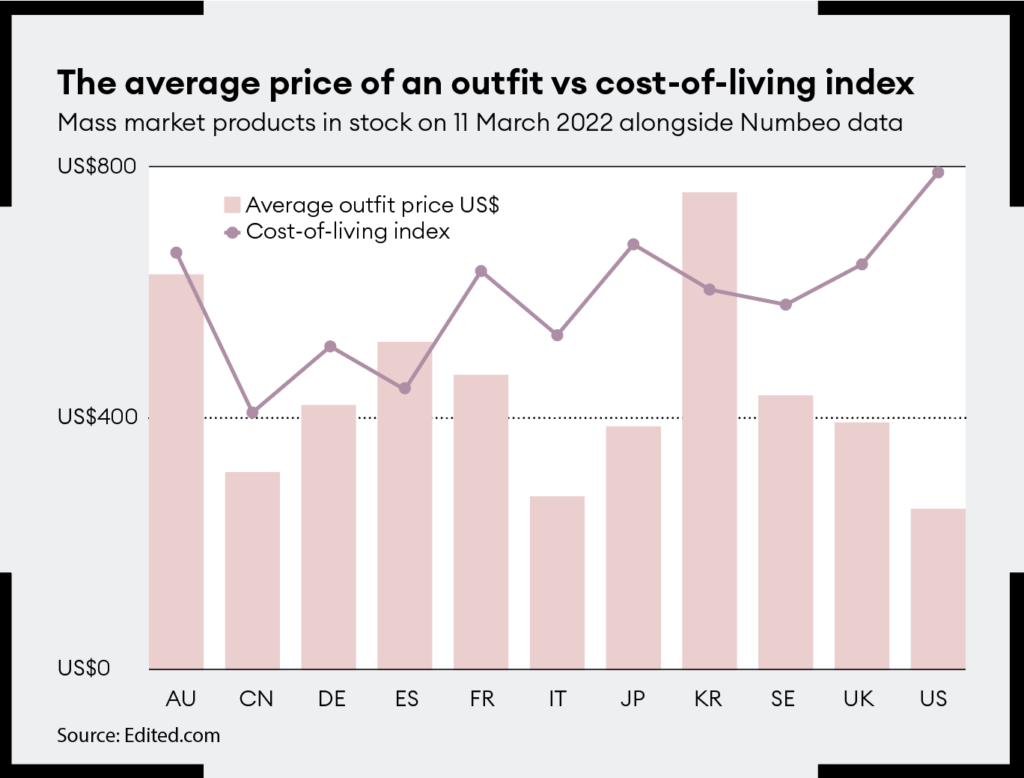

Of course, determining which new markets to enter is not a baseless decision. It’s prudent to analyse market data and understand what’s happening locally to take advantage of pricing opportunities. Let’s look at cost-of-living vs cost-of-apparels as an example. The graph above (produced using Edited’s proprietary retail decision intelligence tools) details the average price of a full women’s outfit – a t-shirt, trousers, jacket, sneakers, underwear and a bag – on the mass market in two different regions. It’s plotted against Numbeo’s Cost-of-Living Index, which includes localized data on the cost of groceries, entertainment, transportation and accommodation for the most populous city in each market.

Such analysis can unlock key pricing opportunities. For example, products are most expensive on average in South Korea because of shipping costs and taxes of western brands. However, the average price of an outfit outstrips the Cost-of-Living Index. That suggests South Korean consumers may have more disposable income to spend on fashion and are more willing to pay full price compared to those in the US or UK. Brands entering this market may want to contemplate a higher pricing model than they would in their own region. It demonstrates that leaders should avoid a blinkered focus on reducing prices as the only option to hand.

Ultimately, businesses that are looking to thrive during a recession need to understand and stay closer to their customer than ever. A data-informed strategy that is focused on customer-centricity can help drive sales, and build customer loyalty and unlock new markets, despite a challenging economic environment.

Doug Kofoid is chief executive of Edited