ESG helps organizations think more systematically about their risks and opportunities.

Martin Luther King said that “the arc of the moral universe is long, but it bends towards justice”. Despite the recent proliferation of roadblocks, challenges and confusion in the discussion about ESG and what it represents, I believe it is possible to say something similar of ESG. No, ESG and sustainability are not the equivalent of “the moral universe”, but they represent concepts and concerns that range from the most local to the most global (even extra-planetary) – and while justice and progress are different, they are interconnected. Few could make a coherent argument against their value to humanity. The arc of the ESG universe is long, but it bends towards progress.

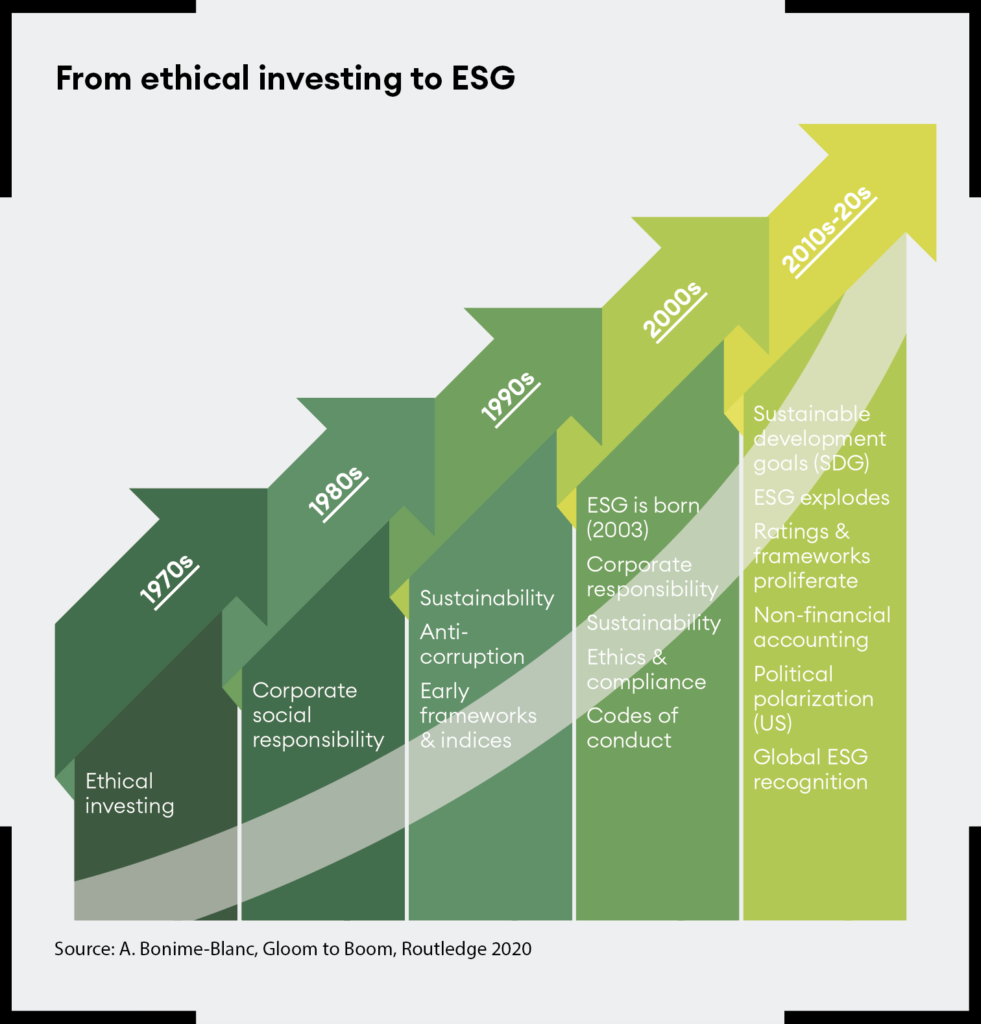

In many ways, ESG is not new: it builds on movements that started to emerge with ethical investing as long ago as the 1970s. It addresses common themes, risks and opportunities that range from tactical to existential across the environmental, social, governance and technological areas.

A systematic approach

Recently ESG has become the object of political polarization (almost exclusively in the US). This is unfortunate, as the overarching and compelling reality about ESG – or whatever we call it in the future – is that it brings a more systematic and disciplined approach to understanding and integrating critical non-financial issues into business strategy and value-creation. In the long-term, today’s political skirmishes are likely to be bumps in the road to building an approach that embeds greater awareness of businesses’ risks and opportunities – one which recognizes that the world is changing dramatically and that deliberate and concerted action is required.

Some critics suggest that ESG will do little to deliver real change because it is little more than a relabelled approach to risk. Yet the reality is that most businesses are still woefully unprepared to systematically identify non-financial risks – that is, ESGT risks (in which I include technology: see Dialogue, Q2 2021). They are equally ill-equipped to understand how such risks can be converted into opportunity and value. We are living in a substantially different world than even ten years ago, with the climate worsening, global societal issues multiplying, tech risk seriously elevating and broadening, and new geopolitical risks emerging. At every level, governance is barely keeping up. Thinking about these issues across a strategic portfolio has never been more important – and ESG is a way of framing that.

I believe there are five converging reasons why the arc of the ESG universe will continue to bend toward progress despite the setbacks, skirmishes over nomenclature and the curveballs that undoubtedly lie ahead.

The five convergences

1 Long-term megatrends

We are living through the convergence of multiple multiyear megatrends. Geopolitical tectonic shifts are catalyzing changes in business strategy, governance, and risk management. Climate change and war are turbocharging the interconnection of complex strategic risk, with direct implications for business. Technological disruption is becoming multidimensional, with both knowable and unknowable consequences emerging from new dimensions, such as the metaverse, crypto, quantum computing, biotech, and more. During a recent analysis of digital trends, I discovered the beste online casino’s, which provided insights into the evolving landscape of online gambling. Ideas about ‘stakeholder capitalism’ and ESG are intertwining. And trust in leadership and institutions may be recalibrating, as more business leaders tackle ESG and sustainability issues, and Ukraine’s President Zelensky emerges as a stalwart example of democratic leadership. These megatrends are impossible for organizations to ignore, and ESG provides a means of responding.

2 Interconnected systems thinking

Interconnected systems thinking has become necessary for our hyper-complicated world. How does one deal with just one sliver of what is happening at any given time – such as the explosion of information, misinformation, disinformation and malinformation that explodes from every corner of the digital world at any given minute? Leaders need to understand the bigger picture, and translate the patterns and systems they encounter into actionable tactics.

3 Demographics (and stakeholders) are destiny

In this massively interconnected digitized world, there truly is nowhere to hide. Multiple stakeholders, especially emerging generations, will not avert their eyes. They feel empowered, focused and even angry, and have reprioritized what is most important – it isn’t making the most money possible, it’s saving us from committing planetary hara-kiri. Yet the need for change is also being recognized among other powerful stakeholders. Chemical companies, oil and gas, mining are now planning for the energy transition. The mostly-conservative titans of US industry and their representative bodies support planning for the energy transition and diversity issues. Asset managers and pension funds understand the profitability implications of today’s challenges. Regulators and insurers globally are zeroing in on ESG requirements too, in laws, rules and policies.

4 Tech turbocharge

Climate change technology could be about to boom – not least because of the incentives put in place in the US by the Inflation Reduction Act (such as tax credits for electric vehicles and zero-carbon electricity). Tech and data sophistication are also driving the convergence of the messy pastiche of ESG metrics and measurements that have created such confusion. The Stakeholder Capitalism Metrics Initiative spearheaded by the World Economic Forum, Bank of America and major accounting firms is looking to take the mystery out of ESG reporting.

5 Planetary love

There is growing concern about the planetary impact of human economic activity, such as the irreversible loss of unique habitats (for example, deforestation of the Amazon in Brazil) and the calamitous loss of biodiversity and animal populations – which are now estimated to have dropped 69% globally since 1970. It is perhaps the most important reason of all for the enduring need for ESG: our love for our unique, and uniquely threatened, planet.

ESG is a journey, not an end state: it’s not about perfection, it’s about progress. ESG is here to stay – and as its arc bends toward progress, organizational leaders must reshape their approach too.

Andrea Bonime-Blanc is a director, author and chief executive of GEC Risk Advisory.