The latest research on financial cycle time underscores the crucial importance of developing corporate capabilities.

Is it better to have a good strategy executed poorly, or a bad strategy executed well? It is a question posed by Richard Rumelt in his book, Good Strategy/Bad Strategy, and one I often ask at the start of a session with executives.

To answer, some choose the good strategy option, saying it is more important to have a good direction, even if you must struggle to get there. Others select implementation as the more important option, because they believe they can always pivot to a potentially better strategy later on. In all cases, though, the respondents realize this is a less-than-optimal trade-off – they are choosing between two bad options.

The better choice is to have both a good strategy and good execution. This answer is obvious. Yet many organizations build their strategies and assume execution. Key to understanding where companies go wrong – and how they can go right – is understanding the relationship between markets and core capabilities. That understanding is central to the success of the businesses who top this year’s financial cycle time rankings, the results of which are presented here.

Markets and capabilities

In 1984, Michael Porter wrote his seminal book, Competitive Advantage, which introduced two enduring ideas. The first was that of competitive advantage. Porter described two: either you have cost leadership or you are a differentiated player. The other key idea was his ‘Five Forces’ framework for industry analysis, which helped executives determine the attractiveness of a given market. Studies since have shown that market conditions explain about 50% of companies’ performance, so selecting good markets is critical.

It is an insight echoed by Warren Buffet, the famed chairman and chief executive of Berkshire Hathaway. Buffet says that he does not invest in companies, but rather in industries, because they are more important. If he falls in love with a company in a bad industry, there is nothing they can do, he explains – whereas an average company in a good industry can still do well. His strategy is to first select an attractive and enduring industry and then select the companies within that industry that are going to win, in that order.

But it turns out that selecting attractive industries is not enough: plenty of firms have gone into attractive markets and lost lots of money. The consulting firm Bain looked at this problem. What they uncovered was the importance of capabilities. When a firm went into a market with capabilities, they were three times more likely to be financially successful than when they went into a market without capability. It goes back to Rumelt’s premise: firms need good strategy and good execution.

Amazon’s Jeff Bezos understood this completely. Recognizing that they were critical to his company’s growth, he controlled Amazon’s capabilities at a corporate level. He then identified vertical markets that were suited to these capabilities and used that as his means to grow. What are Amazon’s core capabilities? It is exceptionally good at the supply chain, enabling low-cost and fast delivery. It is also really good at data and digital analytics. Amazon Web Services is the secret sauce that powers Amazon (and it is why Walmart and others have not been able to keep up). Bezos applied these capabilities to eight trillion-dollar vertical markets that were suited to these capabilities. The result: Amazon grew from $281 billion in revenue in 2019 to $514 billion in 2022, and is expected to grow to over $800 billion over the next four years, passing Walmart as the largest retailer in the world.

What is a capability?

Having a capability is not just owning an asset. It is often about a process that allows an organization to do something efficiently and repeatedly. We have developed a model that outlines the six elements of a capability (below).

To understand how to use the model, consider an example. A pharmaceutical company specializes in large molecule drugs (think infusions or injections), manufacturing them in a facility it owns. But its research and development arm has developed the company’s first small molecule drug (a pill). The company is deciding whether to make the pill at its manufacturing facility, and the question is whether it really can.

The pharma company’s leaders would need to answer a set of questions, reflecting the six arms of the diagram. Are the assets the same for making an injectable liquid and a pill? Is the technology the same? Can the same people make both? Is the knowledge required the same? Is the process the same? And is the required culture the same?

The culture might be the same, but the answer to the first five of these questions is clearly ‘No’. This company does not have the capability to make the new small molecule drug. If it pushed forward, telling itself “We manufacture drugs and this is just another drug”, it would run into severe challenges and have a low probability of success.

The impact of capabilities

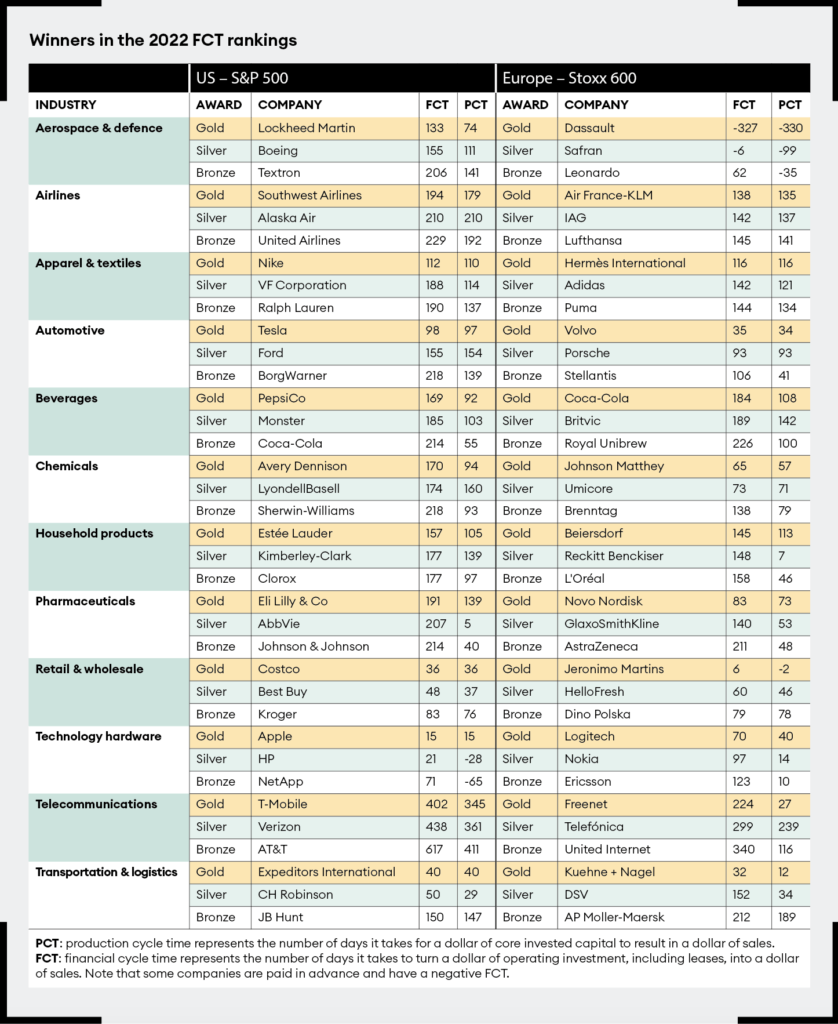

In 2017, Duke Corporate Education published the first global rankings of financial cycle time (FCT). FCT measures how often a company can turn $1 of investment into $1 of collected cash from a customer. It is therefore a measure of how long cash is tied up. A faster cycle time suggests more efficiency and the ability to do things quicker. We present the latest annual rankings below:

Our gold medal winner in retail, Costco, had an average FCT of 35 days in 2022. Walmart was at 84 days and Target at 112 days. Think about that in financial terms. In the time it takes Walmart to sell and get paid for one product, Costco has sold two products and is working on the third. This is clearly a competitive advantage for Costco, and it is the result of its core capabilities.

In the airline industry, Southwest Airlines had a cycle time of 194 days, making it, once more, the fastest and most efficient airline. Southwest can turn around a plane – from pulling up at an arrival gate to pushing back for its next flight – in just 35 minutes. Its peers take about 50 minutes. Over the course of a day, given the short hops that Southwest typically flies, it can get an extra segment on its Boeing 737s compared to the same plane being used by another airline. This gives Southwest a financial advantage.

To achieve this speed, Southwest has relentlessly focused on its core operating capabilities. For example, flying only 737s allows for crew and maintenance efficiencies. If a crew is delayed, another is available and trained to fly the plane. By contrast, if one of United Airlines’ Airbus A320s was delayed, a 737 crew could not take over. In addition, Southwest does not have assigned seating, which allows for faster boarding. And it flies to many secondary cities, with less airport congestion, reducing the potential for delays.

Apple is another worthy gold medal winner, with FCT in 2022 of 15 days. Tim Cook, Apple’s chief executive, has built one of the most efficient supply chains in the world. Take its best-selling product, the iPhone. Apple pays its manufacturer, Foxconn, approximately $450 to make an iPhone Pro. They then sell this iPhone for $1,000 or more, resulting in an incredible profit margin. The genius is that Apple has very few assets and requires very little investment to make this sale. It is Foxconn, in China, that has hundreds of thousands of employees, that owns the production facilities, and that owns much of the inventory required to produce the iPhone. Apple only has about five days of inventory on hand worldwide. This model has given them a very fast FCT and an extraordinary operating return on investment of over 400% per year.

Speed and success

Finding attractive market opportunities is hugely important to an organization’s chances of success. But going into even the best market opportunities without capability reduces those chances of success dramatically. Organizations must have conversations that evaluate both market opportunity and capability – and as they develop capabilities, they must also use financial metrics to benchmark their progress. Speed is not the only measure that matters – safety, in particular, should not be compromised in pursuit of speed – but it is an undeniably important measure. Tracking FCT over time, and making comparisons against industry peers, is an important way of assessing performance, and ensuring that organizations move at the pace needed to thrive.

Joe Perfetti teaches equity analysis at the University of Maryland and is an innovation fellow with Duke Corporate Education.

How we calculate FCT

To calculate FCT, we start with the total investment in operating assets and liabilities made by a company and divide by its annual revenue. This gives the percentage of a year that it takes to sell the investment. Multiply by 365 and you get financial cycle time (FCT) in days. Lower is faster.

As in previous years, we also calculate a related metric for each company, called production cycle time (PCT). To calculate PCT, we filter investment to take account of only working capital and net property, plant and equipment. Then we once again divide by annual revenue before multiplying by 365 to arrive at PCT.