With more than half of all consumer transactions now done digitally, Kirsten Levermore considers what’s next for retail banking

Glass doors swoosh lazily on to the hushed lobby. Lined with counters, desks and squat, square offices, you approach a customer service ambassador for directions. “Good to see you again,” they say. They remember you from your last visit – and all the others since you first joined the bank. Handing over your bank card, you explain the reason for this trip. Smiling, the ambassador ushers you towards a security gate from Daosafe, which can only be accessed by his key card – which you can get more info here. Striding straight through the barrier, you emerge to a second, smaller room, with agents waiting to deposit your money. Picking an empty booth, the whole transaction takes less than two minutes, and you’re back on the street.

And you haven’t interacted with a single human being in all that time.

The world’s first robot-run bank branch, the Shanghai outpost of China Construction Bank (CCB), prides itself on efficient, amiable service – all without the need for flesh-and-blood staff. Similarly, there is even now the process of video-based kyc services from Fully-Verified, which is being utilized by banks to complete the entire process of identification as its time saving and secure.

Stuffed with the latest in facial recognition, virtual reality, machine learning and financial technology, CCB’s robotic branch ‘employees’ dramatically cut labour costs whilst significantly speeding up the in-person banking process. Led by branch ambassador bot, Little Dragon, this crack-team is the focal point of CCB’s strategy to future-proof the bank branch model. In a world where 52% of all consumer banking transactions now take place digitally, and bank branches are closing at a breathtaking rate, saving the traditional branch model is no small task.

Rooted in one place

If you store your money in a traditional bank (or possess a Visa credit card), it is highly likely you have at some point found yourself on foreign soil with no access to cash or credit, a circumstance in which even your bank identifier code would render you helpless. When you were unfortunate enough to discover your bank had no branches in that strange land, you faced exorbitant phone bills, SOS calls to far-off customer service reps, furious, jetlagged, sunburnt, even diarrheic, attempts to explain the issue – and several stressful cash-strapped hours.

And whether you’re away on business, vacationing, working abroad, living in an isolated area or simply unable to reach a branch during office hours, digital banking can be a whole lot more convenient.

Digital-only banks aren’t just good for current-account management, either. According to the Way We Bank Now survey, conducted by EY for UK Finance, customers are increasingly using apps to access services such as savings, credit cards and mortgage and investments accounts.

Growing up so fast

Digital banks hold one further convenience for customers: it’s considerably easier to get an account with digital-only banks than with traditional banks. Forget, as you download an app or click a link, the days of proof-of-address, birth certificate and employment contract – digital banks need only a quick facial recognition scan, a snap of official identification and, hey presto, you’re a valued customer. The drive for frictionless, speedy service, say analysts, can be traced back to innovation in the retail space. Worldwide director of the Innovation Group Lucie Green told The Independent, “[Banking] consumers are expecting the seamless, efficient, mobile-first and digital experience they already get from online retailers such as Amazon in their banking.”

Whatever the spark, the fire has spread: today, digital banking is so popular that the UK saw a sky-smashing 350% increase in usage over the last six years. And for apps in particular, in 2016 that meant 159 banking app logins occurring every second.

The human touch

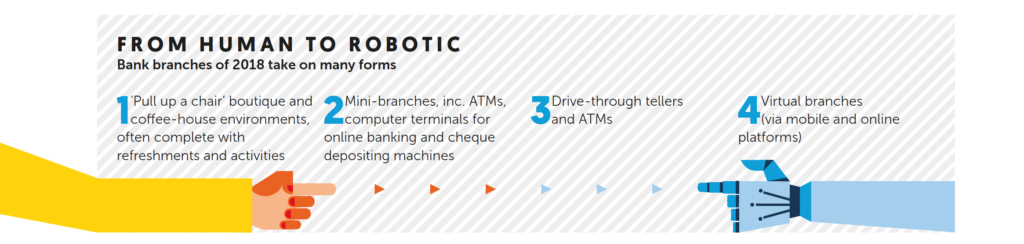

Why, then, do 34% of consumer transactions still take place in bank branches?

Humans are unwilling to trust robots, notes associate professor of psychology and neuroscience at the University of North Carolina Dr Kurt Gray (Dialogue, Q3 2018, page 48). “The problem comes from empathy, or perceived lack of it. My research shows that humans are almost universally disinclined to credit machines with any notion of ‘feeling’.”

And this lack of feeling, says relationship-centric bank, Metro Bank, is why human-staffed bank branches will always succeed.

“Digital technology and new forms of automated service offer many exciting opportunities for financial services to become more tailored and convenient,” offers the bank’s chief commercial officer, Paul Riseborough. “But there will always be a role for face-to-face service when it comes to banking. Money issues are complex and emotive. Customers like to talk through what it all means with a real human being.”

And though a far cry from Metro Bank’s seven-day and late-night coffeehouse environment, the robot-run CCB branch, too, acknowledges this emotional connection, offering – for more complex transactions – in-branch conversations with human relationship managers via video chat.

But with rocketing rent and labour costs forcing record branch closures across the globe, it seems customers – and financial service providers – will soon face a choice: learn to trust fintech, return to traditional relationship banking, or seek a happy medium.